CHAPTER 31—EMBEZZLEMENT AND THEFT

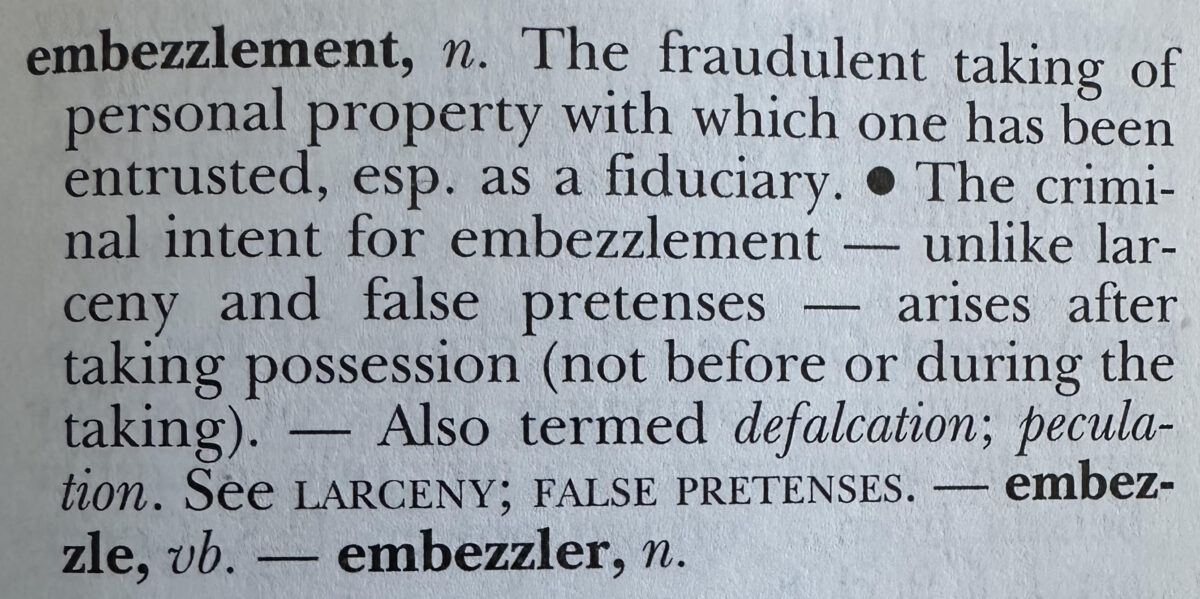

“EMBEZZLEMENT ” Definition:

According to Black’s Law Dictionary,

“embezzlement, n. The fraudulent taking of personal property with which one has been entrusted, esp. as a fiduciary. • The criminal intent for embezzlement — unlike larceny and false pretenses – arises after taking possession (not before or during the taking). — Also termed defalcation; peculation. See LARCENY; FALSE PRETENSES. — embez-zle, ub. — embezzler, n.”

“BLACK’S LAW DICTIONARY” is a registered trademark of Thomson/West.

Registered in U.S. Patent and Trademark Office.

COPYRIGHT © 1891, 1910, 1933, 1951, 1957, 1968, 1979, 1990 WEST PUBLISHING CO.

© West, a Thomson business, 1999, 2004

© 2005 Thomson/West

610 Opperman Drive

P.O. Box 64526

St. Paul, MN 55164-0526

1-800-328-9352

Printed in the United States of America

ISBN 0-314-15863-4

(b) <<NOTE: 18 USC 3551 note.>> Amendment of Sentencing Reform Act

of 1984.–

For purposes of section 235(b) of the Sentencing Reform Act of

1984 (18 U.S.C. 3551 note; Public Law 98-473; 98 Stat. 2032),

as such

section relates to chapter 311 of title 18, United States Code, and the

United States Parole Commission, each reference in such section to “36

years and 129 days” or “36-year and 129-day period”

[[Page 138 STAT. 452]]

Sec.

641.

Public money, property or records.

642.

Tools and materials for counterfeiting purposes.

643.

Accounting generally for public money.

644.

Banker receiving unauthorized deposit of public money.

645.

Court officers generally.

646.

Court officers depositing registry moneys.

647.

Receiving loan from court officer.

648.

Custodians, generally, misusing public funds.

649.

Custodians failing to deposit moneys; persons affected.

650.

Depositaries failing to safeguard deposits.

651.

Disbursing officer falsely certifying full payment.

652.

Disbursing officer paying lesser in lieu of lawful amount.

653.

Disbursing officer misusing public funds.

654.

Officer or employee of United States converting property of another.

655.

Theft by bank examiner.

656.

Theft, embezzlement, or misapplication by bank officer or employee.

657.

Lending, credit and insurance institutions.

658.

Property mortgaged or pledged to farm credit agencies.

659.

Interstate or foreign shipments by carrier; State prosecutions.

660.

Carrier’s funds derived from commerce; State prosecutions.

661.

Within special maritime and territorial jurisdiction.

662.

Receiving stolen property,1 within special maritime and territorial jurisdiction.

663.

Solicitation or use of gifts.

664.

Theft or embezzlement from employee benefit plan.

665.

Theft or embezzlement from employment and training funds; improper inducement; obstruction of investigations.

666.

Theft or bribery concerning programs receiving Federal funds.

667.

Theft of livestock.

668.

Theft of major artwork.

669.

Theft or embezzlement in connection with health care.

670.

Theft of medical products.

Editorial Notes

Amendments

2012—Pub. L. 112–186, §2(b), Oct. 5, 2012, 126 Stat. 1428, added item 670.

1996—Pub. L. 104–294, title VI, §601(f)(7), Oct. 11, 1996, 110 Stat. 3500, inserted comma after “embezzlement” in item 656.

Pub. L. 104–191, title II, §243(b), Aug. 21, 1996, 110 Stat. 2017, added item 669.

1994—Pub. L. 103–322, title XXXII, §320902(d)(1), Sept. 13, 1994, 108 Stat. 2124, added item 668.

1984—Pub. L. 98–473, title II, §§1104(b), 1112, Oct. 12, 1984, 98 Stat. 2144, 2149, added items 666 and 667.

1978—Pub. L. 95–524, §3(b), Oct. 27, 1978, 92 Stat. 2018, substituted “employment and training funds” for “manpower funds” and inserted “; obstruction of investigations” after “improper inducement” in item 665.

1973—Pub. L. 93–203, title VII, §711(b), formerly title VI, §611(b), Dec. 28, 1973, 87 Stat. 882, renumbered Pub. L. 93–567, title I, §101, Dec. 31, 1974, 88 Stat. 1845, added item 665.

1966—Pub. L. 89–654, §1(e), Oct. 14, 1966, 80 Stat. 904, substituted “shipments by carrier” for “baggage, express or freight” in item 659.

1962—Pub. L. 87–420, §17(b), Mar. 20, 1962, 76 Stat. 42, added item 664.

Statutory Notes and Related Subsidiaries

Saint Lawrence Seaway Development Corporation

Application of general penal statutes relating to larceny, embezzlement, or conversion of public moneys or property of the United States, to moneys and property of Saint Lawrence Seaway Development Corporation, see section 990 of Title 33, Navigation and Navigable Waters.

[Reference to Saint Lawrence Seaway Development Corporation deemed to be reference to the Great Lakes St. Lawrence Seaway Development Corporation, see section 512(b) of div. AA of Pub. L. 116–260, set out as a note under section 981 of Title 33, Navigation and Navigable Waters.]

1 So in original. Does not conform to section catchline.

§641. Public money, property or records

Whoever embezzles, steals, purloins, or knowingly converts to his use or the use of another, or without authority, sells, conveys or disposes of any record, voucher, money, or thing of value of the United States or of any department or agency thereof, or any property made or being made under contract for the United States or any department or agency thereof; or

Whoever receives, conceals, or retains the same with intent to convert it to his use or gain, knowing it to have been embezzled, stolen, purloined or converted—

Shall be fined under this title or imprisoned not more than ten years, or both; but if the value of such property in the aggregate, combining amounts from all the counts for which the defendant is convicted in a single case, does not exceed the sum of $1,000, he shall be fined under this title or imprisoned not more than one year, or both.

The word “value” means face, par, or market value, or cost price, either wholesale or retail, whichever is greater.

(June 25, 1948, ch. 645, 62 Stat. 725; Pub. L. 103–322, title XXXIII, §330016(1)(H), (L), Sept. 13, 1994, 108 Stat. 2147; Pub. L. 104–294, title VI, §606(a), Oct. 11, 1996, 110 Stat. 3511; Pub. L. 108–275, §4, July 15, 2004, 118 Stat. 833.)

Historical and Revision Notes

Based on title 18, U.S.C., 1940 ed., §§82, 87, 100, 101 (Mar. 4, 1909, ch. 321, §§35, 36, 47, 48, 35 Stat. 1095, 1096-1098; Oct. 23, 1918, ch. 194, 40 Stat. 1015; June 18, 1934, ch. 587, 48 Stat. 996; Apr. 4, 1938, ch. 69, 52 Stat. 197; Nov. 22, 1943, ch. 302, 57 Stat. 591.)

Section consolidates sections 82, 87, 100, and 101 of title 18, U.S.C., 1940 ed. Changes necessary to effect the consolidation were made. Words “or shall willfully injure or commit any depredation against” were taken from said section 82 so as to confine it to embezzlement or theft.

The quoted language, rephrased in the present tense, appears in section 1361 of this title.

Words “in a jail” which followed “imprisonment” and preceded “for not more than one year” in said section 82, were omitted. (See reviser’s note under section 1 of this title.)

Language relating to receiving stolen property is from said section 101.

Words “or aid in concealing” were omitted as unnecessary in view of definitive section 2 of this title. Procedural language at end of said section 101 “and such person may be tried either before or after the conviction of the principal offender” was transferred to and rephrased in section 3435 of this title.

Words “or any corporation in which the United States of America is a stockholder” in said section 82 were omitted as unnecessary in view of definition of “agency” in section 6 of this title.

The provisions for fine of not more than $1,000 or imprisonment of not more than 1 year for an offense involving $100 or less and for fine of not more than $10,000 or imprisonment of not more than 10 years, or both, for an offense involving a greater amount were written into this section as more in conformity with the later congressional policy expressed in sections 82 and 87 of title 18, U.S.C., 1940 ed., than the nongraduated penalties of sections 100 and 101 of said title 18.

Since the purchasing power of the dollar is less than it was when $50 was the figure which determined whether larceny was petit larceny or grand larceny, the sum $100 was substituted as more consistent with modern values.

The meaning of “value” in the last paragraph of the revised section is written to conform with that provided in section 2311 of this title by inserting the words “face, par, or”.

This section incorporates the recommendation of Paul W. Hyatt, president, board of commissioners of the Idaho State Bar Association, that sections 82 and 100 of title 18, U.S.C., 1940 ed., be combined and simplified.

Also, with respect to section 101 of title 18, U.S.C., 1940 ed., this section meets the suggestion of P. F. Herrick, United States attorney for Puerto Rico, that the punishment provision of said section be amended to make the offense a misdemeanor where the amount involved is $50 or less.

Changes were made in phraseology.

Editorial Notes

Amendments

2004—Pub. L. 108–275, in third par., inserted “in the aggregate, combining amounts from all the counts for which the defendant is convicted in a single case,” after “value of such property”.

1996—Pub. L. 104–294 substituted “$1,000” for “$100” in third par.

1994—Pub. L. 103–322, in third par., substituted “fined under this title” for “fined not more than $10,000” after “Shall be” and for “fined not more than $1,000” after “he shall be”.

Statutory Notes and Related Subsidiaries

Short Title of 1984 Amendment

Pub. L. 98–473, title II, chapter XI, part I (§§1110–1115), §1110, Oct. 12, 1984, 98 Stat. 2148, provided that: “This Part [enacting section 667 of this title and amending sections 2316 and 2317 of this title] may be cited as the ‘Livestock Fraud Protection Act’.”

§642. Tools and materials for counterfeiting purposes

Whoever, without authority from the United States, secretes within, or embezzles, or takes and carries away from any building, room, office, apartment, vault, safe, or other place where the same is kept, used, employed, placed, lodged, or deposited by authority of the United States, any tool, implement, or thing used or fitted to be used in stamping or printing, or in making some other tool or implement used or fitted to be used in stamping or printing any kind or description of bond, bill, note, certificate, coupon, postage stamp, revenue stamp, fractional currency note, or other paper, instrument, obligation, device, or document, authorized by law to be printed, stamped, sealed, prepared, issued, uttered, or put in circulation on behalf of the United States; or

Whoever, without such authority, so secretes, embezzles, or takes and carries away any paper, parchment, or other material prepared and intended to be used in the making of any such papers, instruments, obligations, devices, or documents; or

Whoever, without such authority, so secretes, embezzles, or takes and carries away any paper, parchment, or other material printed or stamped, in whole or part, and intended to be prepared, issued, or put in circulation on behalf of the United States as one of such papers, instruments, or obligations, or printed or stamped, in whole or part, in the similitude of any such paper, instrument, or obligation, whether intended to issue or put the same in circulation or not—

Shall be fined under this title or imprisoned not more than ten years, or both.

(June 25, 1948, ch. 645, 62 Stat. 725; Pub. L. 103–322, title XXXIII, §330016(1)(K), Sept. 13, 1994, 108 Stat. 2147.)

Historical and Revision Notes

Based on title 18, U.S.C., 1940 ed., §269 (Mar. 4, 1909, ch. 321, §155, 35 Stat. 1117).

Words “bed piece, bed-plate, roll, plate, die, seal, type, or other” were omitted as covered by “tool, implement, or thing.”

Minor changes in phraseology were made.

Editorial Notes

Amendments

1994—Pub. L. 103–322 substituted “fined under this title” for “fined not more than $5,000” in last par.

§643. Accounting generally for public money

Whoever, being an officer, employee or agent of the United States or of any department or agency thereof, having received public money which he is not authorized to retain as salary, pay, or emolument, fails to render his accounts for the same as provided by law is guilty of embezzlement, and shall be fined under this title or in a sum equal to the amount of the money embezzled, whichever is greater, or imprisoned not more than ten years, or both; but if the amount embezzled does not exceed $1,000, he shall be fined under this title or imprisoned not more than one year, or both.

(June 25, 1948, ch. 645, 62 Stat. 726; Pub. L. 103–322, title XXXIII, §330016(1)(H), (2)(G), Sept. 13, 1994, 108 Stat. 2147, 2148; Pub. L. 104–294, title VI, §606(a), Oct. 11, 1996, 110 Stat. 3511.)

Historical and Revision Notes

Based on title 18, U.S.C., 1940 ed., §176 (Mar. 4, 1909, ch. 321, §90, 35 Stat. 1105).

Word “employee” was inserted to avoid ambiguity as to scope of section.

Words “or of any department or agency thereof” were added after the words “United States”. (See definitions of the terms “department” and “agency” in section 6 of this title.)

Mandatory punishment provisions phrased in alternative.

The smaller punishment for an offense involving $100 or less was added. (See reviser’s notes under sections 641 and 645 of this title.)

Editorial Notes

Amendments

1996—Pub. L. 104–294 substituted “$1,000” for “$100”.

1994—Pub. L. 103–322, §330016(2)(G), substituted “and shall be fined under this title or in a sum equal to the amount of the money embezzled, whichever is greater, or imprisoned” for “and shall be fined in a sum equal to the amount of the money embezzled or imprisoned”.

Pub. L. 103–322, §330016(1)(H), substituted “fined under this title” for “fined not more than $1,000” after “he shall be”.

§644. Banker receiving unauthorized deposit of public money

Whoever, not being an authorized depositary of public moneys, knowingly receives from any disbursing officer, or collector of internal revenue, or other agent of the United States, any public money on deposit, or by way of loan or accommodation, with or without interest, or otherwise than in payment of a debt against the United States, or uses, transfers, converts, appropriates, or applies any portion of the public money for any purpose not prescribed by law is guilty of embezzlement and shall be fined under this title or not more than the amount so embezzled, whichever is greater, or imprisoned not more than ten years, or both; but if the amount embezzled does not exceed $1,000, he shall be fined not more than $1,000 or imprisoned not more than one year, or both.

(June 25, 1948, ch. 645, 62 Stat. 726; Pub. L. 103–322, title XXXIII, §330016(2)(G), Sept. 13, 1994, 108 Stat. 2148; Pub. L. 104–294, title VI, §606(a), Oct. 11, 1996, 110 Stat. 3511.)

Historical and Revision Notes

Based on title 18, U.S.C., 1940 ed., §182 (Mar. 4, 1909, ch. 321, §96, 35 Stat. 1106).

The smaller punishment for an offense involving $100 or less was added. (See reviser’s notes under sections 641 and 645 of this title.)

Changes were made in phraseology.

Editorial Notes

Amendments

1996—Pub. L. 104–294 substituted “does not exceed $1,000” for “does not exceed $100”.

1994—Pub. L. 103–322 substituted “shall be fined under this title or not more than the amount so embezzled, whichever is greater, or imprisoned” for “shall be fined not more than the amount so embezzled or imprisoned”.

§645. Court officers generally

Whoever, being a United States marshal, clerk, receiver, referee, trustee, or other officer of a United States court, or any deputy, assistant, or employee of any such officer, retains or converts to his own use or to the use of another or after demand by the party entitled thereto, unlawfully retains any money coming into his hands by virtue of his official relation, position or employment, is guilty of embezzlement and shall, where the offense is not otherwise punishable by enactment of Congress, be fined under this title or not more than double the value of the money so embezzled, whichever is greater, or imprisoned not more than ten years, or both; but if the amount embezzled does not exceed $1,000, he shall be fined under this title or imprisoned not more than one year, or both.

It shall not be a defense that the accused person had any interest in such moneys or fund.

(June 25, 1948, ch. 645, 62 Stat. 726; Pub. L. 103–322, title XXXIII, §330016(1)(H), (2)(G), Sept. 13, 1994, 108 Stat. 2147, 2148; Pub. L. 104–294, title VI, §606(a), Oct. 11, 1996, 110 Stat. 3511.)

Historical and Revision Notes

Based on title 18, U.S.C., 1940 ed., §186 (May 29, 1920, ch. 212, 41 Stat. 630).

The smaller punishment for an offense involving $100 or less was inserted to conform to section 641 of this title which represents a later expression of congressional intent.

Minor changes were made in phraseology.

Editorial Notes

Amendments

1996—Pub. L. 104–294 substituted “$1,000” for “$100”.

1994—Pub. L. 103–322, §330016(2)(G), substituted “be fined under this title or not more than double the value of the money so embezzled, whichever is greater, or imprisoned” for “be fined not more than double the value of the money so embezzled or imprisoned”.

Pub. L. 103–322, §330016(1)(H), substituted “fined under this title” for “fined not more than $1,000” after “he shall be”.

§646. Court officers depositing registry moneys

Whoever, being a clerk or other officer of a court of the United States, fails to deposit promptly any money belonging in the registry of the court, or paid into court or received by the officers thereof, with the Treasurer or a designated depositary of the United States, in the name and to the credit of such court, or retains or converts to his own use or to the use of another any such money, is guilty of embezzlement and shall be fined under this title or not more than the amount embezzled, whichever is greater, or imprisoned not more than ten years, or both; but if the amount embezzled does not exceed $1,000, he shall be fined under this title or imprisoned not more than one year, or both.

This section shall not prevent the delivery of any such money upon security, according to agreement of parties, under the direction of the court.

(June 25, 1948, ch. 645, 62 Stat. 726; Pub. L. 103–322, title XXXIII, §330016(1)(H), (2)(H), Sept. 13, 1994, 108 Stat. 2147, 2148; Pub. L. 104–294, title VI, §606(a), Oct. 11, 1996, 110 Stat. 3511.)

Historical and Revision Notes

Based on title 18, U.S.C., 1940 ed., §185 (Mar. 4, 1909, ch. 321, §99, 35 Stat. 1106; May 29, 1920, ch. 214, §1, 41 Stat. 654).

The smaller punishment for an offense involving $100 or less was inserted for the reasons outlined in reviser’s notes to sections 641 and 645 of this title.

Minor changes were made in phraseology.

Editorial Notes

Amendments

1996—Pub. L. 104–294 substituted “$1,000” for “$100”.

1994—Pub. L. 103–322, §330016(2)(H), substituted “shall be fined under this title or not more than the amount embezzled, whichever is greater, or imprisoned” for “shall be fined not more than the amount embezzled, or imprisoned”.

Pub. L. 103–322, §330016(1)(H), substituted “fined under this title” for “fined not more than $1,000” after “he shall be”.

Executive Documents

Transfer of Functions

Functions of all officers of Department of the Treasury, and functions of all agencies and employees of such Department, transferred, with certain exceptions, to Secretary of the Treasury, with power vested in him to authorize their performance or performance of any of his functions, by any of such officers, agencies, and employees, by Reorg. Plan No. 26 of 1950, §§1, 2, eff. July 31, 1950, 15 F.R. 4935, 64 Stat. 1280, 1281, set out in the Appendix to Title 5, Government Organization and Employees. The Treasurer of the United States, referred to in this section, is an officer of Department of the Treasury.

§647. Receiving loan from court officer

Whoever knowingly receives, from a clerk or other officer of a court of the United States, as a deposit, loan, or otherwise, any money belonging in the registry of such court, is guilty of embezzlement, and shall be fined under this title or not more than the amount embezzled, whichever is greater, or imprisoned not more than ten years, or both; but if the amount embezzled does not exceed $1,000, he shall be fined under this title or imprisoned not more than one year, or both.

(June 25, 1948, ch. 645, 62 Stat. 727; Pub. L. 103–322, title XXXIII, §330016(1)(H), (2)(G), Sept. 13, 1994, 108 Stat. 2147, 2148; Pub. L. 104–294, title VI, §606(a), Oct. 11, 1996, 110 Stat. 3511.)

Historical and Revision Notes

Based on title 18, U.S.C., 1940 ed., §187 (Mar. 4, 1909, ch. 321, §100, 35 Stat. 1107).

The punishment provision of section 185 of title 18, U.S.C., 1940 ed., now section 646 of this title, was substituted for the words “punished as prescribed in section 185 of this title” and the smaller punishment for an offense involving $100 or less was inserted. (See reviser’s notes under sections 641 and 645 of this title.)

Editorial Notes

Amendments

1996—Pub. L. 104–294 substituted “$1,000” for “$100”.

1994—Pub. L. 103–322, §330016(2)(G), substituted “shall be fined under this title or not more than the amount embezzled, whichever is greater, or imprisoned” for “shall be fined not more than the amount embezzled or imprisoned”.

Pub. L. 103–322, §330016(1)(H), substituted “fined under this title” for “fined not more than $1,000” after “he shall be”.

§648. Custodians, generally, misusing public funds

Whoever, being an officer or other person charged by any Act of Congress with the safe-keeping of the public moneys, loans, uses, or converts to his own use, or deposits in any bank, including any branch or agency of a foreign bank (as such terms are defined in paragraphs (1) and (3) of section 1(b) of the International Banking Act of 1978), or exchanges for other funds, except as specially allowed by law, any portion of the public moneys intrusted to him for safe-keeping, is guilty of embezzlement of the money so loaned, used, converted, deposited, or exchanged, and shall be fined under this title or in a sum equal to the amount of money so embezzled, whichever is greater, or imprisoned not more than ten years, or both; but if the amount embezzled does not exceed $1,000, he shall be fined under this title or imprisoned not more than one year, or both.

(June 25, 1948, ch. 645, 62 Stat. 727; Pub. L. 101–647, title XXV, §2597(d), Nov. 29, 1990, 104 Stat. 4909; Pub. L. 103–322, title XXXIII, §330016(1)(H), (2)(G), Sept. 13, 1994, 108 Stat. 2147, 2148; Pub. L. 104–294, title VI, §606(a), Oct. 11, 1996, 110 Stat. 3511.)

Historical and Revision Notes

Based on title 18, U.S.C., 1940 ed., §175 (Mar. 4, 1909, ch. 321, §89, 35 Stat. 1105).

Mandatory punishment provision was rephrased in the alternative.

The smaller punishment for an offense involving $100 or less was inserted. (See reviser’s notes under sections 641 and 645 of this title.)

Minor changes in phraseology were made.

Editorial Notes

References in Text

Section 1(b) of the International Banking Act of 1978, referred to in text, is classified to section 3101 of Title 12, Banks and Banking.

Amendments

1996—Pub. L. 104–294 substituted “$1,000” for “$100”.

1994—Pub. L. 103–322, §330016(2)(G), substituted “shall be fined under this title or in a sum equal to the amount of money so embezzled, whichever is greater, or imprisoned” for “shall be fined in a sum equal to the amount of money so embezzled or imprisoned”.

Pub. L. 103–322, §330016(1)(H), substituted “fined under this title” for “fined not more than $1,000” after “he shall be”.

1990—Pub. L. 101–647 inserted “, including any branch or agency of a foreign bank (as such terms are defined in paragraphs (1) and (3) of section 1(b) of the International Banking Act of 1978),” after “or deposits in any bank”.

§649. Custodians failing to deposit moneys; persons affected

(a) Whoever, having money of the United States in his possession or under his control, fails to deposit it with the Treasurer or some public depositary of the United States, when required so to do by the Secretary of the Treasury or the head of any other proper department or agency or by the Government Accountability Office, is guilty of embezzlement, and shall be fined under this title or in a sum equal to the amount of money embezzled, whichever is greater, or imprisoned not more than ten years, or both; but if the amount embezzled is $1,000 or less, he shall be fined under this title or imprisoned not more than one year, or both.

(b) This section and sections 643, 648, 650 and 653 of this title shall apply to all persons charged with the safe-keeping, transfer, or disbursement of the public money, whether such persons be charged as receivers or depositaries of the same.

(June 25, 1948, ch. 645, 62 Stat. 727; Pub. L. 103–322, title XXXIII, §330016(1)(H), (2)(G), Sept. 13, 1994, 108 Stat. 2147, 2148; Pub. L. 104–294, title VI, §606(a), Oct. 11, 1996, 110 Stat. 3511; Pub. L. 108–271, §8(b), July 7, 2004, 118 Stat. 814.)

Historical and Revision Notes

Based on title 18, U.S.C., 1940 ed., §§177, 178 (Mar. 4, 1909, ch. 321, §§91, 92, 35 Stat. 1105; May 29, 1920, ch. 214, §1, 41 Stat. 654; June 10, 1921, ch. 18, §304, 42 Stat. 24).

Sections were consolidated.

Words “or agency” were inserted after “department”. See definition of “agency” in section 6 of this title.

Mandatory punishment provisions made in alternative.

The smaller punishment for an offense involving $100 or less was inserted. (See reviser’s notes under sections 641, 645 of this title.)

Minor changes were made in phraseology.

Editorial Notes

Amendments

2004—Subsec. (a). Pub. L. 108–271 substituted “Government Accountability Office” for “General Accounting Office”.

1996—Subsec. (a). Pub. L. 104–294 substituted “$1,000” for “$100”.

1994—Subsec. (a). Pub. L. 103–322, §330016(2)(G), substituted “shall be fined under this title or in a sum equal to the amount of money embezzled, whichever is greater, or imprisoned” for “shall be fined in a sum equal to the amount of money embezzled or imprisoned”.

Pub. L. 103–322, §330016(1)(H), substituted “fined under this title” for “fined not more than $1,000” after “he shall be”.

Executive Documents

Transfer of Functions

Functions of all officers of Department of the Treasury, and functions of all agencies and employees of such Department, transferred, with certain exceptions, to Secretary of the Treasury, with power vested in him to authorize their performance or performance of any of his functions, by any of such officers, agencies, and employees, by Reorg. Plan No. 26 of 1950, §§1, 2, eff. July 31, 1950, 15 F.R. 4935, 64 Stat. 1280, 1281, set out in the Appendix to Title 5, Government Organization and Employees. The Treasurer of the United States, referred to in this section, is an officer of Department of the Treasury.

§650. Depositaries failing to safeguard deposits

If the Treasurer of the United States or any public depositary fails to keep safely all moneys deposited by any disbursing officer or disbursing agent, as well as all moneys deposited by any receiver, collector, or other person having money of the United States, he is guilty of embezzlement, and shall be fined under this title or in a sum equal to the amount of money so embezzled, whichever is greater, or imprisoned not more than ten years, or both; but if the amount embezzled does not exceed $1,000, he shall be fined under this title or imprisoned not more than one year, or both.

(June 25, 1948, ch. 645, 62 Stat. 727; Pub. L. 103–322, title XXXIII, §330016(1)(H), (2)(G), Sept. 13, 1994, 108 Stat. 2147, 2148; Pub. L. 104–294, title VI, §606(a), Oct. 11, 1996, 110 Stat. 3511.)

Historical and Revision Notes

Based on title 18, U.S.C., 1940 ed., §174, (Mar. 4, 1909, ch. 321, §88, 35 Stat. 1105; May 29, 1920, ch. 214, §1, 41 Stat. 654.)

Mandatory punishment provisions stated in alternative.

The smaller punishment for offenses involving $100 or less was added. (See reviser’s note under sections 641, 645 of this title.)

Minor changes were made in phraseology.

Editorial Notes

Amendments

1996—Pub. L. 104–294 substituted “$1,000” for “$100”.

1994—Pub. L. 103–322, §330016(2)(G), substituted “shall be fined under this title or in a sum equal to the amount of money so embezzled, whichever is greater, or imprisoned” for “shall be fined in a sum equal to the amount of money so embezzled or imprisoned”.

Pub. L. 103–322, §330016(1)(H), substituted “fined under this title” for “fined not more than $1,000” after “he shall be”.

Executive Documents

Transfer of Functions

Functions of all officers of Department of the Treasury, and functions of all agencies and employees of such Department, transferred, with certain exceptions, to Secretary of the Treasury, with power vested in him to authorize their performance or performance of any of his functions, by any of such officers, agencies, and employees, by Reorg. Plan No. 26 of 1950, §§1, 2, eff. July 31, 1950, 15 F.R. 4935, 64 Stat. 1280, 1281, set out in the Appendix to Title 5, Government Organization and Employees. The Treasurer of the United States, referred to in this section, is an officer of Department of the Treasury.

§651. Disbursing officer falsely certifying full payment

Whoever, being an officer charged with the disbursement of the public moneys, accepts, receives, or transmits to the Government Accountability Office to be allowed in his favor any receipt or voucher from a creditor of the United States without having paid the full amount specified therein to such creditor in such funds as the officer received for disbursement, or in such funds as he may be authorized by law to take in exchange, shall be fined under this title or in double the amount so withheld, whichever is greater, or imprisoned not more than two years, or both; but if the amount withheld does not exceed $1,000, he shall be fined under this title or imprisoned not more than one year, or both.

(June 25, 1948, ch. 645, 62 Stat. 727; Pub. L. 103–322, title XXXIII, §330016(1)(H), (2)(G), Sept. 13, 1994, 108 Stat. 2147, 2148; Pub. L. 104–294, title VI, §606(a), Oct. 11, 1996, 110 Stat. 3511; Pub. L. 108–271, §8(b), July 7, 2004, 118 Stat. 814.)

Historical and Revision Notes

Based on title 18, U.S.C., 1940 ed., §181 (Mar. 4, 1909, ch. 321, §95, 35 Stat. 1106; June 10, 1921, ch. 18, §304, 42 Stat. 24).

The penalty provided by section 652 of this title, a similar section, was incorporated in this section.

(For explanation of the smaller penalty for an offense involving $100 or less, see reviser’s notes under sections 641 and 645 of this title.)

Minor changes were made in phraseology.

Editorial Notes

Amendments

2004—Pub. L. 108–271 substituted “Government Accountability Office” for “General Accounting Office”.

1996—Pub. L. 104–294 substituted “$1,000” for “$100”.

1994—Pub. L. 103–322, §330016(2)(G), substituted “shall be fined under this title or in double the amount so withheld, whichever is greater, or imprisoned” for “shall be fined in double the amount so withheld or imprisoned”.

Pub. L. 103–322, §330016(1)(H), substituted “fined under this title” for “fined not more than $1,000” after “he shall be”.

§652. Disbursing officer paying lesser in lieu of lawful amount

Whoever, being an officer, clerk, agent, employee, or other person charged with the payment of any appropriation made by Congress, pays to any clerk or other employee of the United States, or of any department or agency thereof, a sum less than that provided by law, and requires such employee to receipt or give a voucher for an amount greater than that actually paid to and received by him, is guilty of embezzlement, and shall be fined under this title or in double the amount so withheld, whichever is greater, or imprisoned not more than two years, or both; but if the amount embezzled is $1,000 or less, he shall be fined under this title or imprisoned not more than one year, or both.

(June 25, 1948, ch. 645, 62 Stat. 727; Pub. L. 103–322, title XXXIII, §330016(1)(H), (2)(G), Sept. 13, 1994, 108 Stat. 2147, 2148; Pub. L. 104–294, title VI, §606(a), Oct. 11, 1996, 110 Stat. 3511.)

Historical and Revision Notes

Based on title 18, U.S.C., 1940 ed., §172 (Mar. 4, 1909, ch. 321, §86, 35 Stat. 1105).

Words “or of any department or agency thereof,” were inserted after “United States” so as to eliminate any possible ambiguity as to scope of section. (See definitive section 6 of this title.)

Mandatory punishment provision made in alternative.

The smaller punishment for an offense involving $100 or less was added. (See reviser’s note under sections 641, 645 of this title.)

Minor changes were made in phraseology.

Editorial Notes

Amendments

1996—Pub. L. 104–294 substituted “$1,000” for “$100”.

1994—Pub. L. 103–322, §330016(2)(G), substituted “shall be fined under this title or in double the amount so withheld, whichever is greater, or imprisoned” for “shall be fined in double the amount so withheld or imprisoned”.

Pub. L. 103–322, §330016(1)(H), substituted “fined under this title” for “fined not more than $1,000” after “he shall be”.

§653. Disbursing officer misusing public funds

Whoever, being a disbursing officer of the United States, or any department or agency thereof, or a person acting as such, in any manner converts to his own use, or loans with or without interest, or deposits in any place or in any manner, except as authorized by law, any public money intrusted to him; or, for any purpose not prescribed by law, withdraws from the Treasury or any authorized depositary, or transfers, or applies, any portion of the public money intrusted to him, is guilty of embezzlement of the money so converted, loaned, deposited, withdrawn, transferred, or applied, and shall be fined under this title or not more than the amount embezzled, whichever is greater, or imprisoned not more than ten years, or both; but if the amount embezzled is $1,000 or less, he shall be fined under this title or imprisoned not more than one year, or both.

(June 25, 1948, ch. 645, 62 Stat. 728; Pub. L. 103–322, title XXXIII, §330016(1)(H), (2)(G), Sept. 13, 1994, 108 Stat. 2147, 2148; Pub. L. 104–294, title VI, §606(a), Oct. 11, 1996, 110 Stat. 3511.)

Historical and Revision Notes

Based on title 18, U.S.C., 1940 ed., §173 (Mar. 4, 1909, ch. 321, §87, 35 Stat. 1105; May 29, 1920, ch. 214, §1, 41 Stat. 654).

Words “or any department or agency thereof,” were inserted after “United States” so as to eliminate any possible ambiguity as to scope of section. (See definitive section 6 of this title.)

The smaller punishment for an offense involving $100 or less was added. (See reviser’s note under sections 641, 645 of this title.)

Minor changes were made in phraseology.

Editorial Notes

Amendments

1996—Pub. L. 104–294 substituted “$1,000” for “$100”.

1994—Pub. L. 103–322, §330016(2)(G), substituted “shall be fined under this title or not more than the amount embezzled, whichever is greater, or imprisoned” for “shall be fined not more than the amount embezzled or imprisoned”.

Pub. L. 103–322, §330016(1)(H), substituted “fined under this title” for “fined not more than $1,000” after “he shall be”.

§654. Officer or employee of United States converting property of another

Whoever, being an officer or employee of the United States or of any department or agency thereof, embezzles or wrongfully converts to his own use the money or property of another which comes into his possession or under his control in the execution of such office or employment, or under color or claim of authority as such officer or employee, shall be fined under this title or not more than the value of the money and property thus embezzled or converted, whichever is greater, or imprisoned not more than ten years, or both; but if the sum embezzled is $1,000 or less, he shall be fined under this title or imprisoned not more than one year, or both.

(June 25, 1948, ch. 645, 62 Stat. 728; Pub. L. 103–322, title XXXIII, §330016(1)(H), (2)(H), Sept. 13, 1994, 108 Stat. 2147, 2148; Pub. L. 104–294, title VI, §606(a), Oct. 11, 1996, 110 Stat. 3511.)

Historical and Revision Notes

Based on title 18, U.S.C., 1940 ed., §183 (Mar. 4, 1909, ch. 321, §97, 35 Stat. 1106).

The phrase “Whoever being an officer or agent of the United States or of any department or agency thereof,” was substituted for the words “Any officer connected with, or employed in the Internal Revenue Service of the United States * * * And any officer of the United States, or any assistant of such officer,” in order to clarify scope of section. (See definitive section 6 and reviser’s note thereunder.)

The embezzlement of Government money or property is adequately covered by section 641 of this title.

The smaller punishment for an offense involving $100 or less was added. (See reviser’s notes under sections 641 and 645 of this title.)

Minor changes were made in phraseology.

Editorial Notes

Amendments

1996—Pub. L. 104–294 substituted “$1,000” for “$100”.

1994—Pub. L. 103–322, §330016(2)(H), substituted “shall be fined under this title or not more than the value of the money and property thus embezzled or converted, whichever is greater, or imprisoned” for “shall be fined not more than the value of the money and property thus embezzled or converted, or imprisoned”.

Pub. L. 103–322, §330016(1)(H), substituted “fined under this title” for “fined not more than $1,000” after “he shall be”.

§655. Theft by bank examiner

Whoever, being a bank examiner or assistant examiner, steals, or unlawfully takes, or unlawfully conceals any money, note, draft, bond, or security or any other property of value in the possession of any bank or banking institution which is a member of the Federal Reserve System, which is insured by the Federal Deposit Insurance Corporation, which is a branch or agency of a foreign bank (as such terms are defined in paragraphs (1) and (3) of section 1(b) of the International Banking Act of 1978), or which is an organization operating under section 25 or section 25(a) 1 of the Federal Reserve Act, or from any safe deposit box in or adjacent to the premises of such bank, branch, agency, or organization, shall be fined under this title or imprisoned not more than five years, or both; but if the amount taken or concealed does not exceed $1,000, he shall be fined under this title or imprisoned not more than one year, or both; and shall be disqualified from holding office as a national bank examiner or Federal Deposit Insurance Corporation examiner.

This section shall apply to all public examiners and assistant examiners who examine member banks of the Federal Reserve System, banks the deposits of which are insured by the Federal Deposit Insurance Corporation, branches or agencies of foreign banks (as such terms are defined in paragraphs (1) and (3) of section 1(b) of the International Banking Act of 1978), or organizations operating under section 25 or section 25(a) 1 of the Federal Reserve Act, whether appointed by the Comptroller of the Currency, by the Board of Governors of the Federal Reserve System, by a Federal Reserve Agent, by a Federal Reserve bank, or by the Federal Deposit Insurance Corporation, or appointed or elected under the laws of any State; but shall not apply to private examiners or assistant examiners employed only by a clearing-house association or by the directors of a bank.

(June 25, 1948, ch. 645, 62 Stat. 728; Pub. L. 101–647, title XXV, §2597(e), Nov. 29, 1990, 104 Stat. 4909; Pub. L. 103–322, title XXXIII, §330016(1)(H), (K), Sept. 13, 1994, 108 Stat. 2147; Pub. L. 104–294, title VI, §606(a), Oct. 11, 1996, 110 Stat. 3511.)

Historical and Revision Notes

Based on section 593 of title 12, U.S.C., 1940 ed., Banks and Banking (Dec. 23, 1913, ch. 6, §22, 38 Stat. 272; Sept. 26, 1918, ch. 177, §5, 40 Stat. 970; Feb. 25, 1927, ch. 191, §15, 44 Stat. 1232; Aug. 23, 1935, ch. 614, §326(a), 49 Stat. 715).

Other provisions of section 593 of title 12, U.S.C. 1940 ed., Banks and Banking, are incorporated in sections 217 and 218 of this title.

The words “and shall upon conviction thereof” were omitted as unnecessary, since punishment cannot be imposed until a conviction is secured.

The phrase “bank or banking institution which is a member of the Federal Reserve System or which is insured by the Federal Deposit Insurance Corporation” was substituted for “member bank or insured bank” to avoid the use of a definitive section based on sections 221a, 264(e)(8), and 588a of title 12, U.S.C., 1940 ed., Banks and Banking. Words “banks the deposits of which are insured by the Federal Deposit Insurance Corporation” were substituted for “insured banks” in second paragraph, for the same reason.

Punishment provision harmonized with that of section 656 of this title. (See also, reviser’s notes under sections 641 and 645 of this title.)

Changes in phraseology were also made.

Editorial Notes

References in Text

Section 1(b) of the International Banking Act of 1978, referred to in text, is classified to section 3101 of Title 12, Banks and Banking.

Section 25 of the Federal Reserve Act, referred to in text, is classified to subchapter I (§601 et seq.) of chapter 6 of Title 12. Section 25(a) of the Federal Reserve Act, which is classified to subchapter II (§611 et seq.) of chapter 6 of Title 12, was renumbered section 25A of that act by Pub. L. 102–242, title I, §142(e)(2), Dec. 19, 1991, 105 Stat. 2281.

Amendments

1996—Pub. L. 104–294 substituted “$1,000” for “$100” in first par.

1994—Pub. L. 103–322, in first par., substituted “fined under this title” for “fined not more than $5,000” after “organization, shall be” and for “fined not more than $1,000” after “he shall be”.

1990—Pub. L. 101–647, in first par., substituted “System, which is insured” for “System or which is insured”, inserted “which is a branch or agency of a foreign bank (as such terms are defined in paragraphs (1) and (3) of section 1(b) of the International Banking Act of 1978), or which is an organization operating under section 25 or section 25(a) of the Federal Reserve Act,” after “Federal Deposit Insurance Corporation,” and “branch, agency, or organization,” after “premises of such bank,” and in second par. substituted “System, banks the deposits of which” for “System or banks the deposits of which”, and inserted “branches or agencies of foreign banks (as such terms are defined in paragraphs (1) and (3) of section 1(b) of the International Banking Act of 1978), or organizations operating under section 25 or section 25(a) of the Federal Reserve Act,” after “Federal Deposit Insurance Corporation,”.

1 See References in Text note below.

§656. Theft, embezzlement, or misapplication by bank officer or employee

Whoever, being an officer, director, agent or employee of, or connected in any capacity with any Federal Reserve bank, member bank, depository institution holding company, national bank, insured bank, branch or agency of a foreign bank, or organization operating under section 25 or section 25(a) 1 of the Federal Reserve Act, or a receiver of a national bank, insured bank, branch, agency, or organization or any agent or employee of the receiver, or a Federal Reserve Agent, or an agent or employee of a Federal Reserve Agent or of the Board of Governors of the Federal Reserve System, embezzles, abstracts, purloins or willfully misapplies any of the moneys, funds or credits of such bank, branch, agency, or organization or holding company or any moneys, funds, assets or securities intrusted to the custody or care of such bank, branch, agency, or organization, or holding company or to the custody or care of any such agent, officer, director, employee or receiver, shall be fined not more than $1,000,000 or imprisoned not more than 30 years, or both; but if the amount embezzled, abstracted, purloined or misapplied does not exceed $1,000, he shall be fined under this title or imprisoned not more than one year, or both.

As used in this section, the term “national bank” is synonymous with “national banking association”; “member bank” means and includes any national bank, state bank, or bank and trust company which has become a member of one of the Federal Reserve banks; “insured bank” includes any bank, banking association, trust company, savings bank, or other banking institution, the deposits of which are insured by the Federal Deposit Insurance Corporation; and the term “branch or agency of a foreign bank” means a branch or agency described in section 20(9) of this title. For purposes of this section, the term “depository institution holding company” has the meaning given such term in section 3 of the Federal Deposit Insurance Act.

(June 25, 1948, ch. 645, 62 Stat. 729; Pub. L. 101–73, title IX, §961(b), Aug. 9, 1989, 103 Stat. 499; Pub. L. 101–647, title XXV, §§2504(b), 2595(a)(1), 2597(f), Nov. 29, 1990, 104 Stat. 4861, 4906, 4909; Pub. L. 103–322, title XXXIII, §330016(1)(H), Sept. 13, 1994, 108 Stat. 2147; Pub. L. 104–294, title VI, §§601(f)(1), 606(a), Oct. 11, 1996, 110 Stat. 3499, 3511.)

Historical and Revision Notes

Based on sections 592, 597 of title 12, U.S.C., 1940 ed., Banks and Banking (R.S. 5209; Dec. 23, 1913, ch. 6, §22(i), as added June 19, 1934, ch. 653, §3, 48 Stat. 1107; Sept. 26, 1918, ch. 177, §7, 40 Stat. 972; Aug. 23, 1935, ch. 614, §316, 49 Stat. 712).

Section 592 of title 12, U.S.C., 1940 ed., Banks and Banking, was separated into three sections the first of which, embracing provisions relating to embezzlement, abstracting, purloining, or willfully misapplying moneys, funds, or credits, constitutes part of the basis for this section. Of the other two sections, one section, 334 of this title, relates only to the issuance and circulation of Federal Reserve notes and the other, section 1005 of this title, to false entries or the wrongful issue of bank obligations.

The original section, containing more than 500 words, was verbose, diffuse, redundant, and complicated. The enumeration of banks affected is repeated eight times. The revised section without changing in any way the meaning or substance of existing law, clarifies, condenses, and combines related provisions largely rewritten in matters of style.

The words “national bank” were substituted for “national banking association,” the terms being synonymous by definition of section 221 of title 12, U.S.C., 1940 ed., Banks and Banking, written into the last paragraph of this section. This change made possible the use of the term “such bank” in substitution for the words “such Federal Reserve bank, member bank, or such national banking association, or insured bank,” in each of seven instances.

The special and separate provisions of the original section relating to embezzlement by national bank receivers or Federal Reserve agents are readily combined in the revised section by including these officers in the initial enumeration of persons at whom the act is directed and by inserting the word “purloins” after “embezzles, abstracts,” and the phrase “or any moneys, funds, assets, or securities intrusted to the custody or care,” following the words “of such bank”.

The last paragraph of the revised section includes the definitions of sections 221 and 264(c) of title 12, U.S.C., 1940 ed., Banks and Banking, made applicable by express provision of the original section. These were written in, with only such changes of phraseology as were necessary, in order to make the revised section complete and self-contained. For meaning of “bank,” as used in bank robbery statute, see section 2113 of this title.

Section 597 of title 12, U.S.C., 1940 ed., Banks and Banking, likewise was separated into two parts, one of which was combined with the embezzlement provisions of said section 592 to form this section. The other part was combined with the related provisions of said section 592 to form section 1005 of this title.

It will be noted that section 597 of title 12, U.S.C., 1940 ed., Banks and Banking, was limited to “Whoever, being connected in any capacity with a Federal Reserve bank”; that it enumerated “note, debenture, bond, or other obligation, or draft, mortgage, judgment, or decree”; and that it stipulated punishment by fine of not more than $10,000 or imprisonment of not more than 5 years, or both.

In combining these provisions, the words “or connected in any capacity” were written into the new section after the words “employee of,” thus making them applicable not only to Federal Reserve banks but to the other banks as well. The phrase of section 592 of title 12, U.S.C., 1940 ed., Banks and Banking, “or who, without such authority, issues or puts forth any certificate of deposit, draws any order or bill of exchange, makes any acceptance, assigns any note, bond, draft, bill of exchange, mortgage, judgment, or decree,” was modified to include the enumeration of like obligations in section 597 of title 12, U.S.C., 1940 ed., Banks and Banking, and to read as follows: “whoever without such authority makes, draws, issues, puts forth, or assigns any certificate of deposit, draft, order, bill of exchange, acceptance, note, debenture, bond, or other obligation or mortgage, judgment, or decree”. (See section 1005 of this title.)

As thus changed the new section is clear, simple, and unambiguous. The very slight changes of substance that have been noted, were unavoidable if the two sections were to be combined. Without combination any constructive revision of these duplicitous and redundant provisions was impossible. It is believed that the revised sections adequately and correctly represent the intent of Congress as the same can be gathered from the overlapping and confusing enactments. At any rate, the severest criticism of the revised sections is that a person connected with a Federal Reserve bank who violates these sections can at most be punished by a fine of $5,000 or imprisonment of 5 years, or both, whereas under section 597 of title 12, U.S.C., 1940 ed., Banks and Banking, he might have been fined $10,000 or imprisoned 5 years, or both. Obviously an embezzler will rarely be financially able to pay even a $5,000 fine even where such fine is imposed. Certainly if it is an adequate fine for a national bank president it is not too disproportionate for a person “connected in any capacity with a Federal Reserve bank”.

The smaller punishment for an offense involving $100 or less was added. (See reviser’s notes under sections 641, 645 of this title.)

The words “shall be deemed guilty of a misdemeanor” were omitted as unnecessary in view of definitive section 1 of this title.

The words “upon conviction thereof” were omitted as unnecessary, since punishment cannot be imposed without conviction.

Words “In any district court of the United States” were omitted as unnecessary since section 3231 of this title gives the district courts jurisdiction of criminal prosecution.

Senate Revision Amendment

Certain words were stricken from the section as being unnecessary and inconsistent with other sections of this revision defining embezzlement and without changing existing law. See Senate Report No. 1620, amendment No. 6, 80th Cong.

Editorial Notes

References in Text

Section 25 of the Federal Reserve Act, referred to in text, is classified to subchapter I (§601 et seq.) of chapter 6 of Title 12, Banks and Banking. Section 25(a) of the Federal Reserve Act, which is classified to subchapter II (§611 et seq.) of chapter 6 of Title 12, was renumbered section 25A of that act by Pub. L. 102–242, title I, §142(e)(2), Dec. 19, 1991, 105 Stat. 2281.

Section 3 of the Federal Deposit Insurance Act, referred to in text, is classified to section 1813 of Title 12.

Amendments

1996—Pub. L. 104–294, in first par., substituted “Federal Reserve Act,” for “Federal Reserve Act,,” and “$1,000” for “$100”.

1994—Pub. L. 103–322, in first par., substituted “fined under this title” for “fined not more than $1,000” after “he shall be”.

1990—Pub. L. 101–647, §2597(f)(1), in first par., directed substitution of “national bank, insured bank, branch or agency of a foreign bank, or organization operating under section 25 or section 25(a) of the Federal Reserve Act,” for “national bank, or insured bank” which was executed by making the substitution for “national bank or insured bank” to reflect the probable intent of Congress, and inserted “insured bank, branch, agency, or organization” after “receiver of a national bank,”, “, branch, agency, or organization” after “misapplies any of the moneys, funds or credits of such bank”, and “branch, agency, or organization” after “custody or care of such bank,”.

Pub. L. 101–647, §2595(a)(1)(A), (B), in first par., inserted “depository institution holding company,” after “Federal Reserve Bank, member bank,” and “or holding company” after “such bank” in two places.

Pub. L. 101–647, §2504(b), in first par., substituted “30 years” for “20 years”.

Pub. L. 101–647, §2597(f)(2), in second par., struck out “and” after “one of the Federal Reserve Banks;” and directed insertion of “; and the term ‘branch or agency of a foreign bank’ means a branch or agency described in section 20(9) of this title” before the period which was executed by making the insertion before the period at end of first sentence to reflect the probable intent of Congress.

Pub. L. 101–647, §2595(a)(1)(C), in second par., inserted at end “For purposes of this section, the term ‘depository institution holding company’ has the meaning given such term in section 3 of the Federal Deposit Insurance Act.”

1989—Pub. L. 101–73, in first par., substituted “$1,000,000” for “$5,000” and “20 years” for “five years”.

1 See References in Text note below.

§657. Lending, credit and insurance institutions

Whoever, being an officer, agent or employee of or connected in any capacity with the Federal Deposit Insurance Corporation, National Credit Union Administration, any Federal home loan bank, the Federal Housing Finance Agency, Farm Credit Administration, Department of Housing and Urban Development, Federal Crop Insurance Corporation, the Secretary of Agriculture acting through the Farmers Home Administration or successor agency, the Rural Development Administration or successor agency, or the Farm Credit System Insurance Corporation, a Farm Credit Bank, a bank for cooperatives or any lending, mortgage, insurance, credit or savings and loan corporation or association authorized or acting under the laws of the United States or any institution, other than an insured bank (as defined in section 656), the accounts of which are insured by the Federal Deposit Insurance Corporation, or by the National Credit Union Administration Board or any small business investment company, or any community development financial institution receiving financial assistance under the Riegle Community Development and Regulatory Improvement Act of 1994, and whoever, being a receiver of any such institution, or agent or employee of the receiver, embezzles, abstracts, purloins or willfully misapplies any moneys, funds, credits, securities or other things of value belonging to such institution, or pledged or otherwise intrusted to its care, shall be fined not more than $1,000,000 or imprisoned not more than 30 years, or both; but if the amount or value embezzled, abstracted, purloined or misapplied does not exceed $1,000, he shall be fined under this title or imprisoned not more than one year, or both.

(June 25, 1948, ch. 645, 62 Stat. 729; May 24, 1949, ch. 139, §11, 63 Stat. 90; July 28, 1956, ch. 773, §1, 70 Stat. 714; Pub. L. 85–699, title VII, §703, Aug. 21, 1958, 72 Stat. 698; Pub. L. 87–353, §3(q), Oct. 4, 1961, 75 Stat. 774; Pub. L. 90–19, §24(a), May 25, 1967, 81 Stat. 27; Pub. L. 91–468, §4, Oct. 19, 1970, 84 Stat. 1016; Pub. L. 101–73, title IX, §§961(c), 962(a)(7), (8)(A), Aug. 9, 1989, 103 Stat. 499, 502; Pub. L. 101–624, title XXIII, §2303(e), Nov. 28, 1990, 104 Stat. 3981; Pub. L. 101–647, title XVI, §1603, title XXV, §§2504(c), 2595(a)(2), Nov. 29, 1990, 104 Stat. 4843, 4861, 4907; Pub. L. 103–322, title XXXIII, §§330004(6), 330016(1)(H), Sept. 13, 1994, 108 Stat. 2141, 2147; Pub. L. 103–325, title I, §119(c), Sept. 23, 1994, 108 Stat. 2188; Pub. L. 104–294, title VI, §606(a), Oct. 11, 1996, 110 Stat. 3511; Pub. L. 106–78, title VII, §767, Oct. 22, 1999, 113 Stat. 1174; Pub. L. 110–289, div. A, title II, §1216(c), July 30, 2008, 122 Stat. 2792; Pub. L. 111–203, title III, §377(2), July 21, 2010, 124 Stat. 1569.)

Historical and Revision Notes

1948 Act

Based on sections 1026(b) and 1514(c) of title 7, U.S.C., 1940 ed., Agriculture, and sections 264(u), 984, 1121, 1138d(c), 1311, 1441(c), 1467(c), and 1731(c) of title 12, U.S.C., 1940 ed., Banks and Banking, and section 616(c) of title 15, U.S.C., 1940 ed., Commerce and Trade (Dec. 23, 1913, ch. 6, §12B(u), as added June 16, 1933, ch. 89, §8, 48 Stat. 178; July 17, 1916, ch. 245, §31, fourth paragraph, 39 Stat. 382; July 17, 1916, ch. 245, §211(a), as added Mar. 4, 1923, ch. 252, §2, 42 Stat. 1459; Mar. 4, 1923, ch. 252, title II, §216(a), 42 Stat. 1471; Jan. 22, 1932, ch. 8, §16(c), 47 Stat. 11; July 22, 1932, ch. 522, §21(c), 47 Stat. 738; Mar. 27, 1933, Ex. Ord. No. 6084; June 13, 1933, ch. 64, §8(c), 48 Stat. 135; June 16, 1933, ch. 98, §64(c), 48 Stat. 268; Jan. 31, 1934, ch. 7, §13, 48 Stat. 347; June 27, 1934, ch. 847, §512(c), 48 Stat. 1265; Aug. 23, 1935, ch. 614, §101, 49 Stat. 701; July 22, 1937, ch. 517, title IV, §52(b), 50 Stat. 532; Feb. 16, 1938, ch. 30, title V, §514(c), 52 Stat. 76; Aug. 14, 1946, ch. 964, §3, 60 Stat. 1064).

Each of the eleven sections from which this section was derived contained similar provisions relating to embezzlement, false entries, and fraudulent issuance or assignment of obligations with respect to one or more named agencies or corporations.

These were separated and the embezzlement and misapplication provisions of all form the basis of this section, and with one exception the remaining provisions of each section forming the basis for section 1006 of this title. The sole exception was that portion of said section 616(c) of title 15 as to the disclosure of information which now forms section 1904 of this title.

The revised section condenses and simplifies the constituent provisions without change of substance except as in this note indicated.

The punishment in each section was the same except that in section 1026(b) of title 7, U.S.C., 1940 ed., Agriculture, and sections 984, 1121, and 1311 of title 12, U.S.C., 1940 ed., Banks and Banking, the maximum fine was $5,000. The revised section adopts the $5,000 maximum. (For same penalty covering similar offense, see section 656 of this title.)

The smaller punishment for an offense involving $100 or less was added. (See reviser’s notes to sections 641–645 of this title.)

The enumeration of “moneys, funds, credits, securities, or other things of value” does not occur in any one of the original sections but is an adequate, composite enumeration of the instruments mentioned in each.

References to persons aiding and abetting contained in sections 984, 1121, 1311 of title 12, U.S.C., 1940 ed., Banks and Banking, were omitted as unnecessary, such persons being made principals by section 2 of this title.

The term “receiver” is used in sections 1121 and 1311 of title 12, U.S.C., 1940 ed., Banks and Banking, with reference to Federal intermediate banks and agricultural credit corporations, and is undoubtedly embraced in the term “connected in any capacity with,” but the phrase “and whoever, being a receiver of any such institution” was inserted in this section to obviate all doubt as to its comprehensive scope.

The suggestion has been made that “private examiners” should be included. These undoubtedly are covered by the words “connected in any capacity with.” (See also section 655 of this title.)

The term “or any department or agency of the United States” was inserted in each revised section in order to clarify the sweeping provisions against fraudulent acts and to obviate any possibility of ambiguity by reason of the omission of specific agencies named in the constituent sections. (See section 6 of this title defining “department and agency.” For other verbal changes and deletions see reviser’s note under section 656 of this title.)

Senate Revision Amendment

Certain words were stricken from the section as being unnecessary and inconsistent with other sections of this revision defining embezzlement and without changing existing law. See Senate Report No. 1620, amendment No. 7, 80th Cong.

1949 Act

[Section 11] conforms section 657 of title 18, U.S.C., to administrative practice which in turn was modified to comply with congressional policy “not to use the Farmers Home Corporation to carry out the functions and duties provided for in H.R. 5991 [Farmers Home Administration Act of 1946] but to vest the authority in the Secretary of Agriculture to be administered through the Farmers Home Administration as an agency of the Department of Agriculture” (H. Rept. No. 2683, to accompany H.R. 5991, 79th Cong., 2d sess.).

Editorial Notes

References in Text

The Riegle Community Development and Regulatory Improvement Act of 1994, referred to in text, is Pub. L. 103–325, Sept. 23, 1994, 108 Stat. 2160. For complete classification of this Act to the Code, see Short Title note set out under section 4701 of Title 12, Banks and Banking, and Tables.

Amendments

2010—Pub. L. 111–203 struck out “Office of Thrift Supervision, the Resolution Trust Corporation,” after “National Credit Union Administration,”.

2008—Pub. L. 110–289 substituted “Federal Housing Finance Agency” for “Federal Housing Finance Board”.

1999—Pub. L. 106–78 inserted “or successor agency” after “Farmers Home Administration” and after “Rural Development Administration”.

1996—Pub. L. 104–294 substituted “$1,000” for “$100”.

1994—Pub. L. 103–325 inserted “or any community development financial institution receiving financial assistance under the Riegle Community Development and Regulatory Improvement Act of 1994,” after “small business investment company,”.

Pub. L. 103–322 struck out “Reconstruction Finance Corporation,” before “Federal Deposit Insurance Corporation” and “Farmers’ Home Corporation,” before “the Secretary of Agriculture”, and substituted “under this title” for “not more than $1,000” before “or imprisoned not more than one year, or both”.

1990—Pub. L. 101–647, §2595(a)(2), substituted “Office of Thrift Supervision, the Resolution Trust Corporation, any Federal home loan bank, the Federal Housing Finance Board,” for “Home Owners’ Loan Corporation,”, and directed substitution of “institution, other than an insured bank (as defined in section 656), the accounts of which are insured by the Federal Deposit Insurance Corporation” for “institution the accounts of which are insured by the Federal Savings and Loan Insurance Corporation” which was executed by making the substitution for “institution the accounts of which are insured by the Federal Deposit Insurance Corporation” to reflect the probable intent of Congress and the intervening amendment by Pub. L. 101–647, §1603, see below.

Pub. L. 101–647, §2504(c), substituted “30” for “20” before “years”.

Pub. L. 101–647, §1603, substituted “the Federal Deposit Insurance Corporation” for “the Federal Savings and Loan Insurance Corporation”.

Pub. L. 101–624 substituted “Farmers Home Administration, the Rural Development Administration” for “Farmers’ Home Administration”.

1989—Pub. L. 101–73, §962(a)(8)(A), substituted “the Farm Credit System Insurance Corporation, a Farm Credit Bank, a” for “any land bank, intermediate credit bank,”.

Pub. L. 101–73, §962(a)(7), substituted “National Credit Union Administration Board” for “Administrator of the National Credit Union Administration”.

Pub. L. 101–73, §961(c), substituted “$1,000,000” for “$5,000” and “20 years” for “five years”.

1970—Pub. L. 91–468 inserted reference to National Credit Union Administration and its Administrator.

1967—Pub. L. 90–19 substituted “Department of Housing and Urban Development” for “Federal Housing Administration”.

1961—Pub. L. 87–353 struck out reference to Federal Farm Mortgage Corporation.

1958—Pub. L. 85–699 inserted reference to any small business investment company.

1956—Act July 28, 1956, inserted reference to any institution the accounts of which are insured by the Federal Savings and Loan Insurance Corporation.

1949—Act May 24, 1949, inserted reference to Secretary of Agriculture acting through the Farmers’ Home Administration.

Statutory Notes and Related Subsidiaries

Effective Date of 2010 Amendment

Amendment by Pub. L. 111–203 effective on the transfer date, see section 351 of Pub. L. 111–203, set out as a note under section 906 of Title 2, The Congress.

Exceptions From Transfer of Functions

Functions of corporations of Department of Agriculture; boards of directors and officers of such corporations; Advisory Board of Commodity Credit Corporation; and Farm Credit Administration or any agency, officer, or entity of, under, or subject to supervision of said Administration excepted from functions of officers, agencies, and employees transferred to Secretary of Agriculture by Reorg. Plan No. 2 of 1953, §1, eff. June 4, 1953, 18 F.R. 3219, 67 Stat. 633, set out in the Appendix to Title 5, Government Organization and Employees.

National Credit Union Administration

Establishment as independent agency, membership etc., see section 1752 et seq. of Title 12, Banks and Banking.

Executive Documents

Farm Credit Administration

Establishment of Farm Credit Administration as independent agency, and other changes in status, functions, etc., see Ex. Ord. No. 6084 set out preceding section 2241 of Title 12, Banks and Banking. See also section 2001 et seq. of Title 12.

§658. Property mortgaged or pledged to farm credit agencies

Whoever, with intent to defraud, knowingly conceals, removes, disposes of, or converts to his own use or to that of another, any property mortgaged or pledged to, or held by, the Farm Credit Administration, any Federal intermediate credit bank, or the Federal Crop Insurance Corporation, the Secretary of Agriculture acting through the Farmers Home Administration or successor agency, the Rural Development Administration or successor agency, any production credit association organized under sections 1131–1134m of Title 12, any regional agricultural credit corporation, or any bank for cooperatives, shall be fined under this title or imprisoned not more than five years, or both; but if the value of such property does not exceed $1,000, he shall be fined under this title or imprisoned not more than one year, or both.

(June 25, 1948, ch. 645, 62 Stat. 729; May 24, 1949, ch. 139, §12, 63 Stat. 91; Oct. 31, 1951, ch. 655, §21, 65 Stat. 718; July 26, 1956, ch. 741, title I, §109, 70 Stat. 667; Pub. L. 87–353, §3(r), Oct. 4, 1961, 75 Stat. 774; Pub. L. 101–624, title XXIII, §2303(e), Nov. 28, 1990, 104 Stat. 3981; Pub. L. 103–322, title XXXIII, §§330004(7), 330016(1)(H), (K), Sept. 13, 1994, 108 Stat. 2141, 2147; Pub. L. 104–294, title VI, §606(a), Oct. 11, 1996, 110 Stat. 3511; Pub. L. 106–78, title VII, §767, Oct. 22, 1999, 113 Stat. 1174.)

Historical and Revision Notes

1948 Act

Based on sections 1026(c) and 1514(d) of title 7, U.S.C., 1940 ed., Agriculture, and section 1138d(d) of title 12, U.S.C., 1940 ed., Banks and Banking (June 16, 1933, ch. 98, §64, 48 Stat. 269; Jan. 31, 1934, ch. 7, §13, 48 Stat. 347; July 22, 1937, ch. 517, title IV, §52(c), 50 Stat. 532; Feb. 16, 1938, ch. 30, title V, §514(d), 52 Stat. 76; Aug. 14, 1946, ch. 964, §3, 60 Stat. 1064).

To avoid reference to another section the words “the Farm Credit Administration, any Federal intermediate credit bank, the Federal Farm Mortgage Corporation, Federal Crop Insurance Corporation, Farmers’ Home Corporation, or any production credit corporation or corporation in which a production credit corporation holds stock, any regional agricultural credit corporation, or any bank for cooperatives” were substituted for the words “or any corporation referred to in subsection (a) of this section.”

The punishment provision was completely rewritten. The $2,000 fine of section 1026(c) of title 7, U.S.C., 1940 ed., and the 2-year penalty of that section, section 1514(d) of title 7, U.S.C., 1940 ed., and section 1138(d) of title 12, U.S.C., 1940 ed., were incongruous in juxtaposition with other sections of this chapter and were therefore increased to $5,000 and 5 years. (See sections 656 and 657 of this title.)

The smaller punishment for an offense involving $100 or less was added. (See reviser’s notes under sections 641 and 645 of this title.)

Minor changes were made in phraseology.

1949 Act

[Section 12] conforms section 658 of title 18 U.S.C., to administrative practice which in turn was modified to comply with congressional policy. (See note to sec. 11 [of 1949 Act, set out in Legislative History note under section 657 of title 18]).

Editorial Notes

References in Text

Section 1131 of Title 12, included within the reference to sections 1131 to 1134m of Title 12, was repealed by Pub. L. 89–554, §8(a), Sept. 6, 1966, 80 Stat. 648.

Sections 1131a, 1131c to 1131g, 1131g–2 to 1131i, 1134 to 1134m of Title 12, included within the reference to sections 1131 to 1134m of Title 12, were repealed by Pub. L. 92–181, title V, §5.26(a), Dec. 10, 1971, 85 Stat. 624.

Sections 1131a–1 and 1131j of Title 12, included within the reference to sections 1131 to 1134m of Title 12, are omitted from the Code. Section 1131a–1 of Title 12, was from the Department of Agriculture and Farm Credit Administration Appropriation Act, 1957, and was not repeated in subsequent appropriation acts. Section 1131j was covered by former section 1131g–2 of Title 12, prior to its repeal by Pub. L. 92–181, title V, §5.26(a), Dec. 10, 1971, 85 Stat. 624.

Sections 1131b and 1131g–1 of Title 12, included within the reference to sections 1131 to 1134m of Title 12, were repealed by act July 26, 1956, ch. 741, title 1, §105(c), (q), 70 Stat. 665, 666.

Amendments

1999—Pub. L. 106–78 inserted “or successor agency” after “Farmers Home Administration” and after “Rural Development Administration”.

1996—Pub. L. 104–294 substituted “$1,000” for “$100”.

1994—Pub. L. 103–322, §330016(1)(H), (K), substituted “fined under this title” for “fined not more than $5,000” after “cooperatives, shall be” and for “fined not more than $1,000” after “he shall be”.

Pub. L. 103–322, §330004(7), struck out “Farmers’ Home Corporation,” after “Crop Insurance Corporation,”.

1990—Pub. L. 101–624 substituted “Farmers Home Administration, the Rural Development Administration” for “Farmers’ Home Administration”.

1961—Pub. L. 87–353 struck out reference to the Federal Farm Mortgage Corporation.

1956—Act July 26, 1956, struck out property of any production credit association in which a Production Credit Corporation holds stock.

1951—Act Oct. 31, 1951, covered all production credit associations instead of only those in which a Production Credit Corporation holds stock.

1949—Act May 24, 1949, made section applicable to the Secretary of Agriculture acting through the Farmers’ Home Administration.

Statutory Notes and Related Subsidiaries

Effective Date of 1956 Amendment

Amendment by act July 26, 1956, effective January 1, 1957, see section 202(a) of act July 26, 1956.

Executive Documents

Exceptions From Transfer of Functions

Functions of Corporations of Department of Agriculture; boards of directors and officers of such corporations; Advisory Board of Commodity Credit Corporation; and Farm Credit Administration or any agency, officer, or entity of, under, or subject to supervision of said Administration excepted from functions of officers, agencies, and employees transferred to Secretary of Agriculture by Reorg. Plan No. 2 of 1953, §1, eff. June 4, 1953, 18 F.R. 3219, 67 Stat. 633, set out in the Appendix to Title 5, Government Organization and Employees.

Farm Credit Administration

Establishment of Farm Credit Administration as independent agency, and other changes in status, functions, etc., see Ex. Ord. No. 6084 set out preceding section 2241 of Title 12, Banks and Banking. See also section 2001 et seq. of Title 12.

§659. Interstate or foreign shipments by carrier; State prosecutions

Whoever embezzles, steals, or unlawfully takes, carries away, or conceals, or by fraud or deception obtains from any pipeline system, railroad car, wagon, motortruck, trailer, or other vehicle, or from any tank or storage facility, station, station house, platform or depot or from any steamboat, vessel, or wharf, or from any aircraft, air cargo container, air terminal, airport, aircraft terminal or air navigation facility, or from any intermodal container, trailer, container freight station, warehouse, or freight consolidation facility, with intent to convert to his own use any goods or chattels moving as or which are a part of or which constitute an interstate or foreign shipment of freight, express, or other property; or

Whoever buys or receives or has in his possession any such goods or chattels, knowing the same to have been embezzled or stolen; or

Whoever embezzles, steals, or unlawfully takes, carries away, or by fraud or deception obtains with intent to convert to his own use any baggage which shall have come into the possession of any common carrier for transportation in interstate or foreign commerce or breaks into, steals, takes, carries away, or conceals any of the contents of such baggage, or buys, receives, or has in his possession any such baggage or any article therefrom of whatever nature, knowing the same to have been embezzled or stolen; or

Whoever embezzles, steals, or unlawfully takes by any fraudulent device, scheme, or game, from any railroad car, bus, vehicle, steamboat, vessel, or aircraft operated by any common carrier moving in interstate or foreign commerce or from any passenger thereon any money, baggage, goods, or chattels, or whoever buys, receives, or has in his possession any such money, baggage, goods, or chattels, knowing the same to have been embezzled or stolen—

Shall be fined under this title or imprisoned not more than 10 years, or both, but if the amount or value of such money, baggage, goods, or chattels is less than $1,000, shall be fined under this title or imprisoned for not more than 3 years, or both. If the offense involves a pre-retail medical product (as defined in section 670), it shall be punished under section 670 unless the penalties provided for under this section are greater.

The offense shall be deemed to have been committed not only in the district where the violation first occurred, but also in any district in which the defendant may have taken or been in possession of the said money, baggage, goods, or chattels.

The carrying or transporting of any such money, freight, express, baggage, goods, or chattels in interstate or foreign commerce, knowing the same to have been stolen, shall constitute a separate offense and subject the offender to the penalties under this section for unlawful taking, and the offense shall be deemed to have been committed in any district into which such money, freight, express, baggage, goods, or chattels shall have been removed or into which the same shall have been brought by such offender.

To establish the interstate or foreign commerce character of any shipment in any prosecution under this section the waybill or other shipping document of such shipment shall be prima facie evidence of the place from which and to which such shipment was made. For purposes of this section, goods and chattel shall be construed to be moving as an interstate or foreign shipment at all points between the point of origin and the final destination (as evidenced by the waybill or other shipping document of the shipment), regardless of any temporary stop while awaiting transshipment or otherwise. The removal of property from a pipeline system which extends interstate shall be prima facie evidence of the interstate character of the shipment of the property.

A judgment of conviction or acquittal on the merits under the laws of any State shall be a bar to any prosecution under this section for the same act or acts. Nothing contained in this section shall be construed as indicating an intent on the part of Congress to occupy the field in which provisions of this section operate to the exclusion of State laws on the same subject matter, nor shall any provision of this section be construed as invalidating any provision of State law unless such provision is inconsistent with any of the purposes of this section or any provision thereof.

(June 25, 1948, ch. 645, 62 Stat. 729; May 24, 1949, ch. 139, §13, 63 Stat. 91; Pub. L. 89–654, §1(a)–(d), Oct. 14, 1966, 80 Stat. 904; Pub. L. 103–322, title XXXIII, §330016(1)(H), (K), Sept. 13, 1994, 108 Stat. 2147; Pub. L. 104–294, title VI, §606(a), Oct. 11, 1996, 110 Stat. 3511; Pub. L. 109–177, title III, §307(a), Mar. 9, 2006, 120 Stat. 240; Pub. L. 112–186, §4(a), Oct. 5, 2012, 126 Stat. 1428.)

Historical and Revision Notes

1948 Act